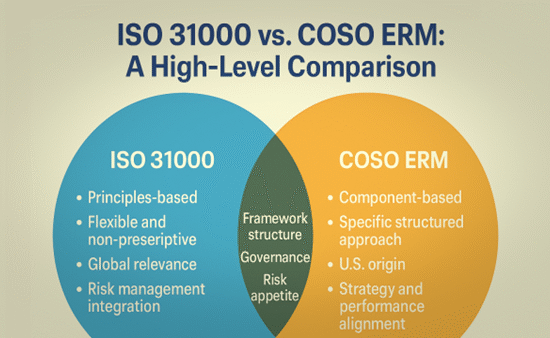

For the Risk Manager, the Article provides excellent point-by-point comparison of the strength and gaps of these two popular global standards. But that an organisation may need to consider implementation…

Browsing CategoryContributed Articles

Taxation On MFs After Budget

The Union Budget 2024-25 brought some changes in taxation with regards to certain categories of mutual funds. Here’s how your taxation will be affected after the change Your allocation to…

Risk Roulette: Why Retail F&O Investors Tend To Bleed Heavily

During FY22-FY24, 1.13 crore unique individual traders incurred a combined net loss of Rs 1.81 lakh crore in F&O. The recently released SEBI (Securities and Exchange Board of India) report …

Easy On The Pocket. Interest Rates Set To Ease; What Does It Mean For You?

Globally, central banks are reducing interest rates; though the Reserve Bank of India (RBI) is yet to commit, there are widespread expectations of interest rates easing going forward There are…

Taxation On MFs After Budget

The Union Budget 2024-25 brought some changes in taxation with regards to certain categories of mutual funds. Here’s how your taxation will be affected after the change Taxation On MFs…

Why Should The RBI Reduce Interest Rates?

The decision to change the repo rate is taken by RBI’s Monetary Policy Committee (MPC), based on multiple variables. The most important variable is inflation. On September 18, the US…

Decoding LTCG. Navigating The New Taxation Scenario

The Union Budget 2024 has brought about uniformity in taxation rules: the holding period is one year for listed instruments and two years for unlisted instruments/physical investments The Union Budget…

How retail flows have come to chase bull markets

Individual ownership in Indian listed companies might be a fraction of promoter ownership. But retail investments have a much bigger bite. Even with a relatively smaller ownership, individuals are significant…

Guide To Build Your MF Portfolio

There are ‘n’ number of funds to choose from and one has to scrutinise several factors, besides just past returns, to make a bouquet of funds that best aligns to…

Plan With Fixed-Income Funds For Retirement

Fixed-income funds lend stability to your portfolio, have better cash flow visibility, and help preserve capital. They can be used in various stages of planning Financial planning for retirement can…

Who Owns The Equity Market?

Domestic institutions now own more than foreign institutions. DIIs, as a group, hold 18.4%, whereas the ownership of FIIs has slipped to 17.9 percent. Once upon a time, our equity…

Unknown Territory. Why Equity Derivatives Are Not For The Uninitiated

Derivatives market is primarily a means of hedging; if you are participating in the derivatives market only, then you are indulging in short-term speculation and not being a long-term investor….