IFAs can look at recommending a limited exposure, say 15% to 20% of the fixed income allocation of the portfolio to credit opportunity funds of well managed AMCs.

The return ‘alpha’ in fixed income funds i.e. returns over and above the baseline return from liquid funds can come from (a) managing the duration of the portfolio i.e. maintaining a long portfolio maturity when interest rate view is positive or (b) the credit exposures in the portfolio

Since the scope of ‘duration play’ looks limited particularly after the change of stance on policy rate easing by the RBI, ‘credit play’ becomes more relevant now.

There are many investment avenues in the debt markets. Credit play debt funds are one such niche investment avenue in the short term bond funds basket and the category AUM is nearing Rs 1 lakh crore, which is approx 5.7% of the industry AUM (as on January 2017) of Rs 17.37 lakh crore and 8.5% of the fixed income AUM of approx Rs 11.7 lakh crore.

Barring one or two exceptions, fund managers do not mix up duration with credit risk in the same fund as these are two distinct risk plays. Most of the credit play funds have portfolio maturity akin to short term funds. The crux of the discussion in this article is whether it is worth the risk, going for the alpha of higher portfolio yield of credit-play funds vis-à-vis the top-notch credit quality in conventional short term bond funds.

To get a perspective on the credit risk in a ‘credit play’ fund, we will look at the credit ratings of the securities in the portfolio. The portfolio composition of credit-play corporate bond funds is largely in AA and A rated securities against predominantly AAA rated exposures in conventional short term funds. AAA being the top-notch credit rating, it carries the highest level of safety whereas AA and A are high / reasonably good credit grade, subject to due diligence carried out by the fund manager on the companies.

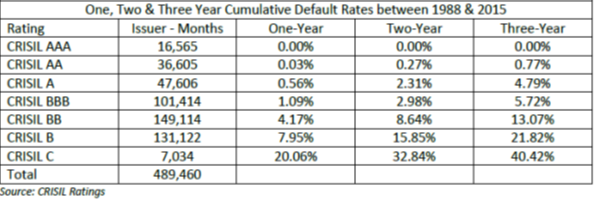

To gauge the default risk in instruments for the respective rating, there is a handy tool, CRISIL default rate study, produced below:

While the table throws a lot of data at us, let’s understand the gist of this:

(a) The probability of default on AAA securities is nil, as per the historical evidence of CRISIL.

(b)The probability of default in A rated papers, when held for one-year, is less than 1% and when held for three years, default probability is less than 5%, which is not alarmingly high.

It is expected that the fund manager will do his job and avoid the potential default candidates. At the end of the day, a credit rating is an opinion of the rating agency and the performance we see above is history. Risk management in a fund is upto the fund manager.

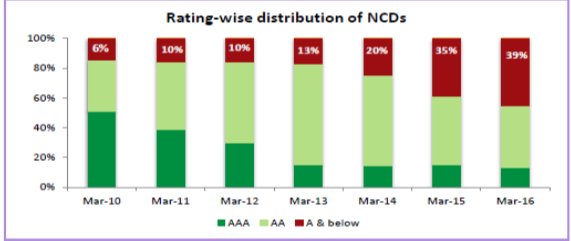

Let us look at the state of the industry, in terms of credit rating break-down in this category:

The data above is a compilation by IDFC MF, on ‘Credit Opportunity Funds’ as categorized by CRISIL. As we can see, the risk in terms of exposure to papers rated less than AAA (light green and maroon bars) has been going up in quest for higher yields. Exposure to A grade has moved up from 6% in Mar 2010 to 39% in Mar 2016. This becomes all the more relevant when we recall the episodes of Amtek Auto, JSPL and BILT; it once again underlines that active tracking of the fundamentals and corporate governance of the underlying companies by the fund manager is vital.

After taking exposure to the higher yielding papers, let us see how much has the portfolio running yield moved up, which gives a perspective on the expected higher return. The running yield of the portfolio is higher by 1.5% to 2% in credit-play funds over conventional short term funds with top-notch credit quality. The recurring fund management expenses being relatively higher in high yield funds, the net running yield is higher by 1% to 1.5%. The issue is: is it worth going for that higher yield at the cost of a little higher credit risk?

On one hand, we have the CRISIL default rate, which is not alarmingly high for investment grade papers, and on the other hand we have incidents like Amtek Auto, JSPL and BILT. SEBI amended a rule in July 2016, which says restrictions on redemptions may be imposed only when there is a systemic crisis e.g. market-wide liquidity crisis or the exchange getting closed for transactions or there is an operational black-out. The meaning of this message is that the ‘side-pocketing’ i.e. separating the bad assets from the portfolio to another small fund that was allowed to one AMC in the Amtek Auto episode will not be allowed in future. It is the AMC’s responsibility to do proper risk management and ensure redemptions to all investors.

Key takeaway: The advisor may recommend a limited exposure, say 15% to 20% of the fixed income allocation of the portfolio, in credit opportunity funds of AMCs with a track record of managing credit funds and having a good risk management system in place. Assuming less-than-AAA exposure at 70% in credit opportunity funds, 20% exposure to these funds implies 14% of the fixed income component being in ‘credit play’. For zeroing down on credit-play funds, it is advisable to opt for well-diversified portfolios, even if the AMC has a good risk management system. The reason is, if the portfolio running yield is higher by 1.5% over conventional short term funds and a credit exposure of 1.5% of the portfolio goes bust (unlikely, extreme case scenario) the investor is at par with other short term funds in the worst case.