The ICRA rating rationale states that rating for the Basel III compliant Tier I bonds is four notches lower than the Basel III complaint Tier II bonds of the bank as these instruments have the following loss absorption features that make them riskier.

We had discussed earlier that Bank Additional Tier I (AT1) Perpetual Bonds are gaining traction in the market. The increasing interest is seen in both the institutional investors i.e. mutual funds, corporate treasuries, PMS providers and the individual investors i.e. high networth individual investors. In the recent past, some events have taken place in this segment of the market, which investors and prospective investors should be aware of. These events are negative, but the segment as a whole remains robust and the events have led to better price discovery i.e. higher yield on the bonds issued by those banks.

The most prominent event is the downgrade of AT1 Perpetual Bonds issued by IDBI Bank. The facts are as follows: on 23 May ’17, ICRA downgraded these bonds from A to BBB-. Other instruments were downgraded as well; certificates of deposit (CDs) were downgraded from A1+ to A1, infrastructure bonds were moved from AA- to A, Basel III compliant Tier II bonds were moved from AA- to A. On the same day, CRISIL downgraded IDBI AT1 Perpetual Bonds from A- to BBB+.

What went wrong? The ICRA rating rationale states that rating for the Basel III compliant Tier I bonds is four notches lower than the Basel III complaint Tier II bonds of the bank as these instruments have the following loss absorption features that make them riskier:

The bank has the full discretion at all times to cancel distribution or payments and the cancellation of discretionary payments shall not be an event of default.

The minimum capital conservation ratio applicable to banks may restrict the bank from servicing these Tier I bonds in case the Common Equity Tier-I (CET-I) falls below the limit prescribed by the RBI.

This is already known; to be noted, the differential between Tier I and Tier II bonds is usually two notches but in this case it is four notches. The rationale also states, “despite a capital infusion of Rs. 1,900 crore in March 2017 by the Government of India, the sharp deterioration in asset quality and consequent increase in credit costs resulted in the bank’s CET-I (including Capital Conservation Buffer) being lower than the required regulatory level as on March 31, 2017. For FY2017, IDBI Bank reported a net loss before tax of Rs. 8,618 crore and net loss after tax of Rs. 5,158 crore as against net loss after tax of Rs. 3,665 crore in FY2016.

As the losses during FY2017 far exceeded the capital infusion by the GoI, the CET-I (including CCB) was lower at 5.64% as on March 31, 2017 as compared with 7.98% as on March 31, 2016. High levels of losses has also significantly eroded the bank’s distributable reserves, which the bank can use to service the coupon on its AT-I bonds. As per the terms of the AT-I instruments, the bank will be constrained from servicing the coupon on these bonds, unless it reports profits and improves its CET-I levels (including CCB) above regulatory levels by divestments of non-core assets and raising fresh capital before the coupon payment dates.” The other weakness, as stated are “weak asset quality profile with gross NPAs at 21.25% and net NPAs at 13.21% as on March 31, 2017” and “large exposure to infrastructure sector (~20% of total exposure as on March 31, 2017), which is prone to cyclical downturns, leading to asset quality pressures”.

However, there are certain strengths as well: majority shareholding of Government of India (approx 74%) and its standing as a developmental financial institution. The CRISIL rating rationale states “strong expectation of support from GoI:

GoI is the majority shareholder in public sector banks (PSBs) and the guardian of India’s financial system. The stability of the banking sector is of prime importance to the government, given the criticality of the sector to the economy, the strong public perception of sovereign backing for PSBs, and the severe implications of any PSB failure in terms of political fallout, systemic stability, and investor confidence in public sector institutions. CRISIL believes the majority ownership creates a moral obligation on the government to support PSBs, including IDBI Bank.

As part of the Indradhanush programme, the government has pledged to infuse at least Rs 70,000 crore in PSBs between 2015 and 2019, of which Rs 25,000 crore was infused in fiscal 2016 and Rs 16,410 crore in fiscal 2017. The government infused Rs 6,284 crore in IDBI Bank in the five fiscals through 2016, and Rs 1,900 crore in March 2017. Furthermore, under the Indradhanush plan, the government has committed that all PSBs will maintain a safe buffer over the regulatory minimum.” The other comfort factor, again from the CRISIL rationale, is “IDBI Bank has an established market position, supported by a large asset base of Rs 361,768 crore as on March 31, 2017. Advances of Rs 190,826 crore accounted for 3% of the banking system advances. While the bank has moderated growth, it is likely to remain among the 10 largest banks in India.”

The other issue in the recent past, in this segment of the market, was the NPA discrepancy of Yes Bank and Axis Bank. Yes Bank’s recent annual report highlights the large divergence visible on NPAs as per Reserve Bank of India (RBI) audit and bank reported numbers for FY16. In contrast to the 0.76% NPLs reported by Yes Bank in FY16, the RBI audit pegged them at 5% of loans. Similarly, according to the RBI, at Axis, NPAs were higher at 4.5% of loans (vs 1.78% reported) and at ICICI Bank they were at 7.0% (vs 5.85%). Detailed disclosures on NPAs will be available in their annual reports. In the case of Yes Bank, management has indicated that during the course of FY17 these accounts have seen repayments and improvements and, therefore, the NPA outstanding for March 2017 is now lower at Rs 1000 crore (1% of FY17 loans). Also, given the growth in loan book and also the recent capital raise, the March 2016 RBI NPA of Rs 4900 crore is now down to 3.7% of loans and 22.3% of net worth.

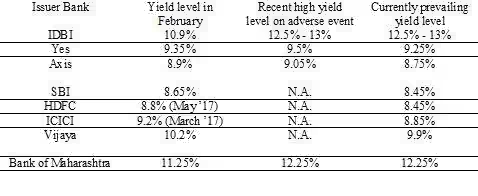

Now let us look at the market reaction. The following table shows the indicative yield level on the AT1 Perpetual Bonds of the Issuers, in February (i.e. the previous article), recent highs on adverse events and current levels after the rally on RBI Policy on 7 June.

Indicative Yield levels

Data Source: Phillip Capital India Fixed Income Desk

Conclusion: For individual investors interested in AT1 Perpetual Bonds, who can trade in lot size of Rs 10 lakh or more through the bond dealing houses offering these papers, should be aware of the risk, discussed above, and settle for a yield that is not the highest. The reason is, where the yield is on the higher side, market participants are indicating that an IDBI Bank like case is a possibility. Otherwise, the stability in yields indicates that the market is confident about these bonds.