The share of individual investors in stock market trades fell to 34.9 percent in FY24, till July 2023 from a 45 percent share in FY21. A look at the increase in inflows through SIP tells us confidence of retail investors is rising. And that’s good news.

In the month of August, the Rs 45-trillion Indian mutual funds industry got inflows worth Rs 15,814 crore through systematic investment plans (SIPs). That’s a new record; an all-time high of inflows through SIPs. In July as well, the SIP book was at a record high of Rs 15,245 crore. But if you look at the retail participation in the stock market, that’s a different story.

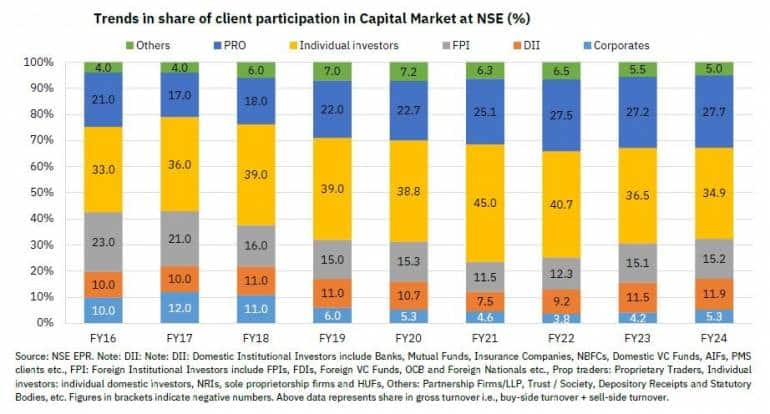

In the stock market, in particular the cash/spot segment, there are various descriptions of investors or traders participating. The relative proportion of participation shows a trend as to which kind of market participant is taking a relatively higher or lower degree of interest. At NSE, we have data on the share of client participation in the capital market segment, excluding the derivatives segment. We have data from 2015-16 to 2023-24, till July 2023.

Trades are placed under five categories, as per profile of the client – proprietary, individual, FPI, DII and corporates. Individual investors include individual domestic investors, NRIs, sole proprietorship firms and HUFs. FPIs are Foreign Institutional Investors including FPIs, FDIs, Foreign VC Funds, OCB and Foreign Nationals. DIIs are Domestic Institutional Investors including banks, mutual funds, insurance companies, NBFCs, Domestic VC Funds, AIFs and PMS clients. There is a residual ‘others’ category for Partnership Firms/LLP, Trust / Society, Depository Receipts and Statutory Bodies, etc.

Who is investing and how much?

The largest participation category is individual investors. In FY 2015-16, this was 33 percent of total trades, in FY 2022-23 it was 36.5 percent. Apparently, nothing much has changed. However, when we scratch the surface, we can see the changes. From 33 percent in FY16, it increased to 45 percent in FY21. The move was visible from 38.8 percent in FY20 to 45 percent in FY21. From there, it has shrunk to 36.5 percent in FY23 and further to 34.9 percent in FY24, till July 2023.

Source: Market Pulse August 2023

FY21 was the year stuck by Covid and lockdown. People started working from home. Being in front of laptops throughout the day, without someone watching over the shoulders, gave leeway to do other things. Playing games is one of those. That apart, a record number of demat accounts were opened. Opening an account with a broking entity online and trading being easily available nowadays, there was a surge. Relatively lesser trades by institutional participants in FY21 increased the percentage share of retail. As lockdown was lifted and workplaces started opening up, free time in front of the laptop was reduced. Individual participation in trades eased to 40.7 percent in FY22, and further to 36.5 percent in FY23. That apart, as and when the market started recovering from the lows of 23 March 2020, some investors, likely first-time investors, started exiting. This is referred to by some people as the ‘Robinhood phenomenon’, where young, first-time investors who have not seen market cycles, tend to exit when they burn their fingers in the market.

The volume share that has increased over the years is that of proprietary trades. From 21 percent in FY16 and 17 percent in FY17, it has increased to 27.2 percent in FY23 and 27.7 percent in FY24 till July 2023. Proprietary traders are brokerage firms and other entities with their own money, referred to as ‘prop book’. With increasing market capitalisation and traded volume, there are enhanced opportunities for trading and investments. The higher volume of trading by prop traders adds to market liquidity as well. Over these years, regulations on client margins have been made stricter, hence trading on prop books is relatively more attractive for brokerage firms, than earlier.

The third largest category by traded volume is FPIs. This has eased over the years. From 23 percent in FY16, it stands at 15.1 percent in FY23. As we have seen over the years, DIIs have proven to be a matching force against FPIs. DII share in traded volume has increased from 10 percent in FY16 to 11.5 percent in FY23. Domestic institutions are more of investors than traders, as compared to, say, prop books. Hence, their share in traded volume is not as much. Corporates are smaller participants now, 4.2 percent in FY23 against 10 percent in FY16.

Are investors investing less in equities?

It would seem from the discussion above that retail participation in the market is decreasing. However, the data is relative to other categories, and in percentage terms. The fact that relative share of individual investors has decreased, does not necessarily mean traded volume has decreased. Overall, market traded volume is increasing. This must be viewed along with enhanced awareness among prospective investors, new demat accounts being opened, new MF SIPs being logged, and higher participation by other categories like prop traders. We have seen a churn over the last few years as a section of individual investors, probably first-time investors, have exited or have become dormant.

A case in point, for a perspective on action from individual investors, is the Mutual Fund systematic investment plan (SIP). MF SIP mobilisation is increasing every month, which is a healthy trend and comprises mostly individual investors. Having said that, cancellations of SIPs are also increasing. That is, SIP mobilisation is increasing, despite increasing cancellations, as more and more new people are joining. We see new demat accounts being opened as well, which shows increasing awareness among prospective investors. For investments in MFs, it is not compulsory to have a demat account, but it shows the broad trends.

What should investors do?

With improved trading systems, availability of online trading platforms, T+1 settlement, and so on, individuals are better placed to participate, than earlier. The India growth story is the driver for the decades to come. It must be noted, trading and investment are different. One is for short-term chance-driven gains and the other is for participation in the India growth story. Retail individuals, who are not in the thick of markets, will do better to be there for the long term.

Source : https://www.moneycontrol.com/news/business/personal-finance/are-individual-equity-investors-moving-towards-mfs-11350731.html