By Joydeep Sen

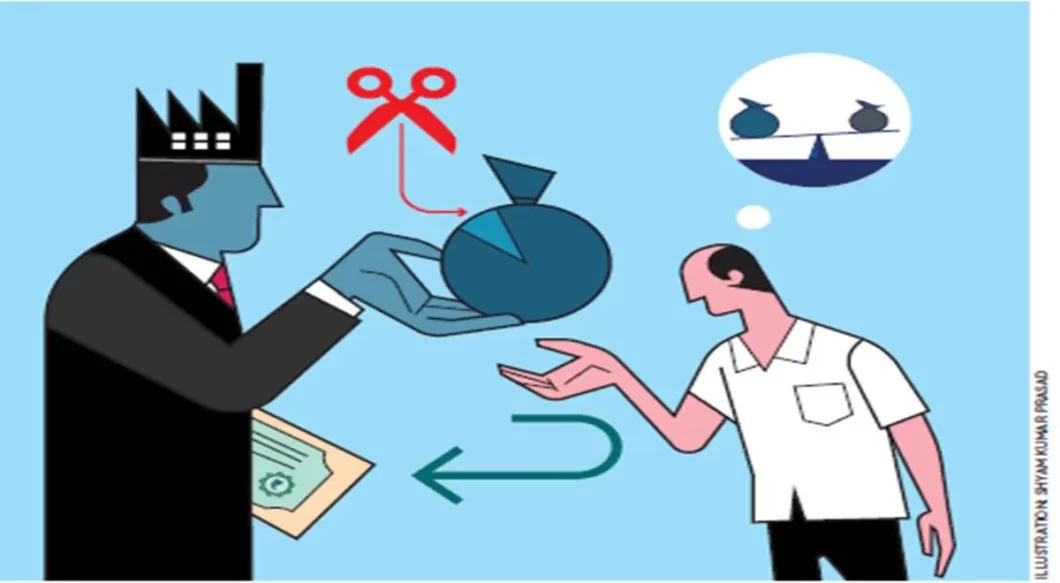

Budget 2019 India: There are various ways a company can reward shareholders. Payment of dividend is the most common method. The other methods are issuance of bonus shares, rights shares at a discount to market price, preferential allotment, buyback of shares, etc. To be noted, shareholders include the promoters, hence rewarding shareholders is not just for a social cause.

Taxation issues

There are taxation issues as well on these financial rewards to shareholders. The most common pay-out, dividend, comes from post-tax profit of the company. There is a dividend distribution tax on the dividend pay-out payable by the company. Dividends, in the hands of the shareholder, is usually tax-free, but if dividends exceed Rs 10 lakh in a financial year for an individual, it is taxable at 10% (plus surcharge and cess as applicable).

Buyback, so far, was free from multiple layers of tax; i.e.; there was no equivalent of dividend distribution tax. For the investor, there was a capital gains tax, which would be short term or long term depending on the period of holding. For a holding period of more than one year, it would be long term capital gain. The purchase cost, if purchased after January 31, 2018, would be the actual purchase cost or if purchased before the ‘grandfathering’ date of January 31, 2018, it would be the market price as on that date.

Tax on buybacks

Now, the Union Budget 2019, proposes a buyback tax on the company, at 20% (plus surcharge and cess as applicable). It is not only the incidence of buyback tax on the company, but the method of computation, which makes it a steep one. If the original issue price of the share was, say, Rs 10 per share and the current market price is Rs 100 per share, and the buyback is at Rs 90, then the tax is imposed on the differential between Rs 90 and Rs 10. That is, the current market price of Rs 100 is ignored. Given that stock price in the secondary market can be multiple times higher than the issue price, this method of taxation is demanding, even prohibitive, on a company contemplating buyback.

The saving grace is, there is no tax on the shareholder, as per the proposal of the Union Budget. There is one Section 10(34A) in Income Tax Act, which states “any income arising to an assessee, being a shareholder, on account of buy back of shares (not being listed on a recognised stock exchange) by the company as referred to in section 115QA” i.e., for unlisted shares, there is no tax on the investor. This is now proposed to be extended to listed shares. Section 115QA states “. . . a domestic company . . . any amount of distributed income by the company on buy-back of shares . . . from a shareholder shall be charged to tax”. This section would be amended to include profit on buyback of listed shares.

Buybacks no longer lucrative

However, given that the tax incidence has been shifted to the company, any company contemplating buyback would carve out the tax component from the kitty. This would effectively reduce the buyback price as compared to market price. This would make it un-remunerative for the shareholder. Hence, effectively the concept of buyback has been pushed back. From the perspective of the tax authorities, they have plugged a loophole of promoters rewarding themselves. This goes in line with the approach of the government to increase public shareholding (non-promoter holding) from minimum 25% to 35%.

If you get a buyback offer from your company, you have to compare the buyback price with the market price. If the current market price / future expectation is better, then you need not tender. Companies would now explore the other options of rewarding shareholders.

Source: https://www.financialexpress.com/budget/budget-2019-buybacks-may-not-be-a-lucrative-option/1646319/