TrainingCentral’s Skill Tests assess skills in regulatory circulars-related business areas amongst your employees.The Tests are customisable to your organisation and can be administered using robust security features to ensure result authenticity.

Key Features

- Questions categorised in differeing severity (complex, moderate, simple) so as to administer to various levels.

- Context-specific and role-specific tests anchored on circulars (RBI/SEBI/IRDA/GoI/Others).

- Local language variations for higher effectiveness available

- Enhance tests with your organisation’s products, policies and other knowledge requirements.

- Proctoring, Restricted Browser Access for Secure Access over Workstations, Mobiles.

- Gamification Option to build competitive deployment and engagement available.

- Content regularly updated in line with the latest regulatory circulars.

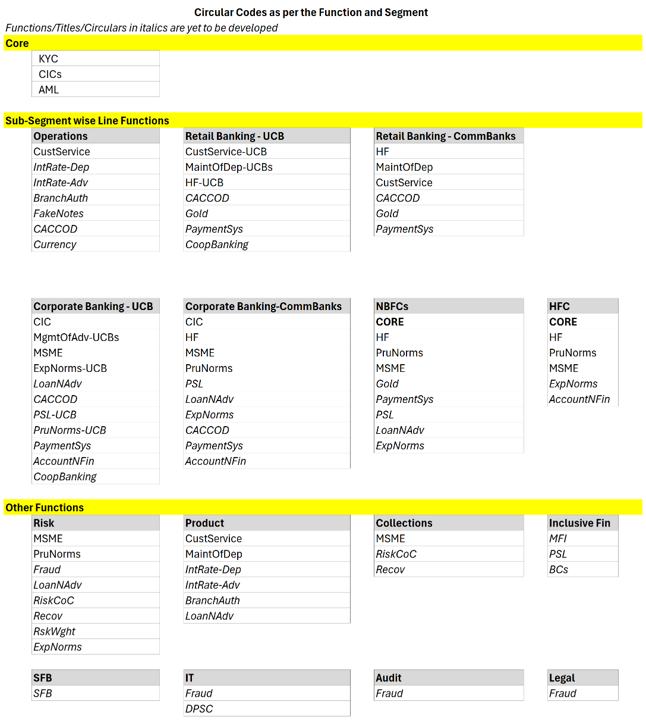

At their core, the Tests have question sets based on Regulatory Circulars (RBI, SEBI, IRDA, Govt., others) covering key business areas of banking, finance, insurance and compliance. These Tests can then be used to create workflows to ensure optimised L&D activities amongst your employees. And supported by TC’s large India-centric course catalogue and Network of Domain Experts, the Tests can be the foundation of blended programs. TC ensures that the question banks are periodically updated. The roadmap list of RBI Circulars is given below.

Pricing

– On a per-user per test basis

– Volume-based slabs with discount pricing

– Options for merging question sets, introduction of gamification may be charged separate.

Reach out to us at contact@trainingcentral.co.in or +91-84339-94860 should you have more queries.

Reach out to us for demo logins.

No. | Master Circular/Master Direction Topics | Institute | Status |

1 | Management of Advances – UCBs | UCBs | |

2 | Maintenance of Deposit Accounts | UCBs | Live |

3 | Housing Finance – UCBs | UCBs | Live |

4 | Amendment to Master Direction on KYC | All | Live |

5 | Master Direction on KYC and AML | All | Live |

6 | Credit Information Companies | All | Live |

7 | Customer Service – UCB | All | Live |

8 | Lending to Micro, Small & Medium Enterprises (MSME) Sector | All | Live |

9 | Interest Rate on Deposits Directions, 2016 | All | Q1 2025-26 |

10 | Frauds – Classification and Reporting by commercial banks and select FIs | All | Q1 2025-26 |

11 | Interest Rate on Advances Directions, 2016 | All | Q1 2025-26 |

12 | Priority Sector Lending (PSL) – Targets and Classification | All | Q1 2025-26 |

13 | Loans and Advances – Statutory and Other Restrictions | All | Q2 2025-26 |

14 | Housing Finance | All | Live |

15 | Customer Service in Banks | All | Live |

16 | Prudential norms on Income Recognition, Asset Classification and Provision… | All | Live |

17 | Rationalisation of Branch Authorisation Policy- Revision of Guidelines | All | Q2 2025-26 |

18 | Guidelines on Managing Risks and Code of Conduct in Outsourcing of Finan… | All | Q2 2025-26 |

19 | Outsourcing of Financial Services – Responsibilities of regulated entities.. | All | Q2 2025-26 |

20 | Financial Inclusion by Extension of Banking Services – Use of Business Corr… | All | Q2 2025-26 |

21 | Review of Prudential Norms – Risk Weights for Exposures to Corporates,.. | All | Q2 2025-26 |

22 | Detection and Impounding of Counterfeit Notes | All | Q2 2025-26 |

23 | Consolidated Circular on Opening of Current Accounts and CC/OD Accounts … | All | Q3 2025-26 |

24 | Digital Payment Security Controls | All | Q3 2025-26 |

25 | Operating Guidelines for Small Finance Banks | SFBs | Q4 2025-26 |

26 | Regulatory Framework for Microfinance Loans Directions, 2022 | MFIs | Q4 2025-26 |

27 | Exposure Norms | All | Under Dev |